You’re probably thrilled that you finally got your driver’s license, and that you can be out on the road with your friends, enjoying their company and your new found freedom.

Unfortunately, there is one thing that you probably hadn’t counted on when you got your driver’s license, and that is the cost of auto insurance. This can be expensive enough, but if you are a new driver, you are more than likely going to end up paying higher rates than someone who has been driving for a few or many years.

If you are living on an allowance, or a small income from an after school job, you may find that you cannot afford to pay insurance and keep gas in your vehicle.

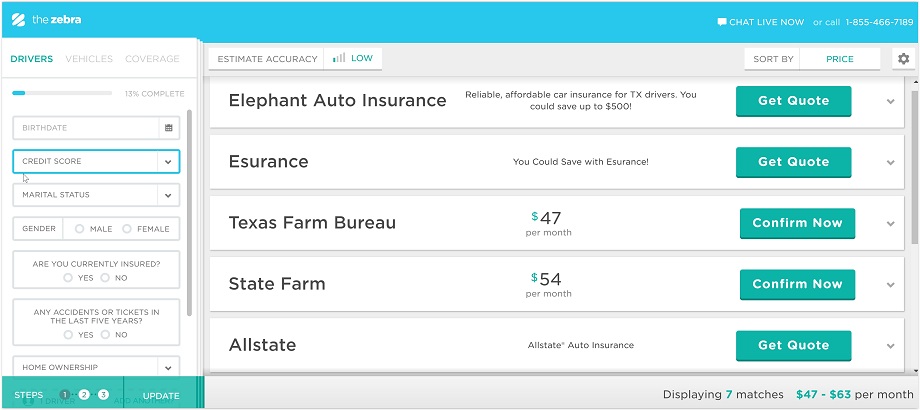

There are things that you can do to get your rates reduced a little bit. Of course, the first thing you need to do is shop around. You should never go with the first insurance quote you get, because you could end up paying a lot more than you really need to be paying. You can go online and request free quotes, and you will get insurance quotes from many different companies.

Then you can sit down and take your time to study each quote, and figure out which company is going to give you the most insurance, at the best rates.

It only takes a few minutes when you request free quotes online, and because you can be completely anonymous, there won’t be any annoying sales people calling you later on, trying to get you to buy insurance from them (often at higher rates than the original quotes you received).

4 Tips To Find the Right Insurance Plan

- 1

Check Out Cheap Insurance Companies

Sometimes it is best not to go with the big name insurance companies, especially if you are a new driver. There are many cheap insurance companies out there these days, and they often offer special rates for new drivers. Sure, your rates are still going to be higher than the rates of more experienced drivers, but they will still be less than what other larger insurance companies will charge.

Usually, you will get the very basic insurance with these types of policies, but this is better than nothing, and it may be all that you can currently afford. After you have been driving and insured for a while, you can always see what the other bigger insurance companies offer, and make the switch when you are eligible for lower rates with those companies.

- 2

Take Driver’s Education and Driver’s Training Classes

You can save a lot of money on auto insurance by taking driver’s education classes. New drivers are hard to insure because they are not always aware of the rules of the road, and they are inexperienced. By taking driver’s training, you can show that you have some driving experience, and that you are fully aware of the rules of the road.

There are all kinds of things you can learn with these classes, which are aimed at making people better drivers. You don’t even have to be a new driver to take these classes and get discounts on your insurance rates. This is going to show insurance companies that you do know what you are doing, and that you are not as much of a risk as other new drivers. It is also going to show that you are really serious about being a safe driver.

- 3

Get on Your Parents’ Insurance

You can save yourself a lot of money on auto insurance if you ask your parents to include you on their policy. As long as you are still living at home and are under a certain age, or you are at college or an accredited center for higher learning, you will be able to be covered by their policy, even if you are driving your own vehicle.

If you are using their vehicle, they probably have already made arrangements for you to be covered when you are driving, and if you have your own vehicle, it is easy to have it added to their policy. The vehicle may have to be registered in one of your parent’s names, but as long as you have your own vehicle to drive whenever you want to, does this really matter all that much?

- 4

Have a Safe Vehicle

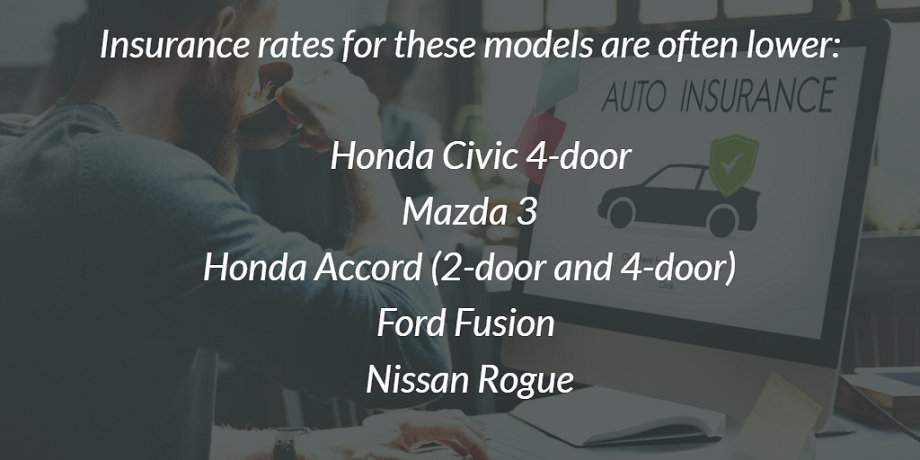

One really big problem for many new drivers, especially teenage drivers, is not having enough money to get a newer model car that is in excellent working condition. For the most part, the majority of people will tell you that their first car was a real junker, and they always wondered if they were going to make it from point A to point B and back again. You can get discounts on your auto insurance if you are driving a newer model vehicle that has all of the latest safety features, including air bags.

The type of vehicle you drive will also play a role in the cost of your insurance rates. For instance, if you settle on a four door sedan, you are going to spend a lot less on insurance than if you go out and get yourself a flashy sports car, which is built for speed, and much harder to insure.

Take insurance into consideration while choosing a car

Make sure that your vehicle does not have tinted windows, and that it does not have things that will make it go faster or have more power, as these things will increase your insurance rates significantly.

If you are a new driver, you have a whole new set of responsibilities, including making sure that you are carrying enough insurance.

Unfortunately, as a new driver, you are probably going to be charged higher rates for your insurance than other drivers who have been on the roads for years.

Here is a short guide that helps you get all the discounts you are entitled to:

If you do your homework, get quotes, take driver’s education, have a good working newer vehicle, and even use your parent’s insurance, you will find that you can save a lot of money. If you are a student, you will definitely want to save money everywhere you can.

Free DMV Practice Tests

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming