If you have never purchased an automobile insurance policy, you will likely be surprised at the cost. Many people pay almost as much for their auto insurance as they do for their vehicles. While drivers must accept that quality auto insurance is not cheap, there are several ways to reduce the cost of your policy.

How To Lower Your Car Insurance Bill

- 1

Take a driver’s education course. Most auto insurance companies offer discounts to drivers who have successfully completed a driver’s education course. Auto insurance policies for young drivers are often more expensive than those for experienced drivers. If your school offers a driver’s education course, take the opportunity to save some money in the future.

- 2

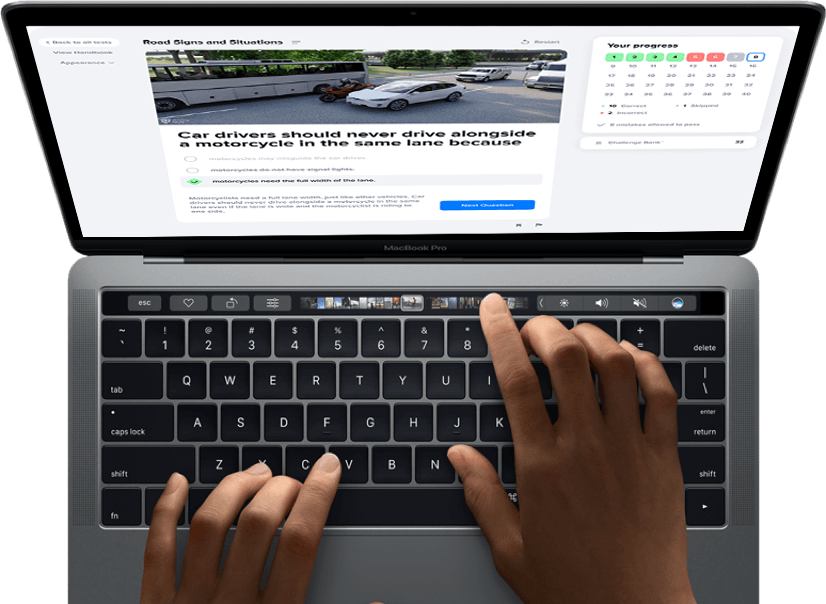

Obey the rules of the road. One of the easiest methods of reducing your auto insurance costs is to practice safe driving strategies. Use your turn signals, stop at stop signs, check your blind spots, practice proper lane usage, and, most importantly, obey the speed limit at all times. All of these things will reduce your chances of getting a traffic citation, a costly mistake by itself that will also be evaluated when insurance companies calculate the price of your policy.

Drivers who receive speeding tickets are considered a higher risk group, and therefore are charged more for insurance![driving citation]()

- 3

Think carefully about the type of vehicle you drive. The amount of money you pay each month for your auto insurance coverage is directly related to the type of vehicle you drive. Large trucks and SUVs, particularly if they have a four wheel drive option, will cost more to insure than small cars.

- 4

Add extras. Several optional accessories can help reduce the cost of your vehicle’s auto insurance. Anti-lock brakes and air bags are popular safety options that will help to lower your monthly insurance payment. You may also qualify for a discount if your vehicle has an anti-theft system.

Most insurance companies will give you a safety discount of 10% if your car is equipped with airbags![rear facing seat]()

- 5

Make good grades. Whether in high school or college, your auto insurance company may offer a discount based on your academic performance.

To be eligible for a discount have at least a 3.0 grade point or “B” average![good grades]()

Any combination of the above tips will significantly reduce the cost of your auto insurance.

Do not be afraid to change from one company to another if you feel the cost of your coverage is too high. Automobile insurance rates are very competitive.