Buying a used vehicle is often a much more feasible endeavor for young drivers than purchasing a brand new one.

If you are planning to enlist the help of your parents to acquire your first car, you can be almost certain that you’ll be heading to the used car lot instead of the showroom floor when you begin the search for the perfect vehicle. Even if you are on your own when it comes to buying a new ride, a well-maintained, low mileage used car is usually a much smarter option than buying a brand new vehicle that will depreciate in value by several thousand dollars as soon as you drive it off the lot.

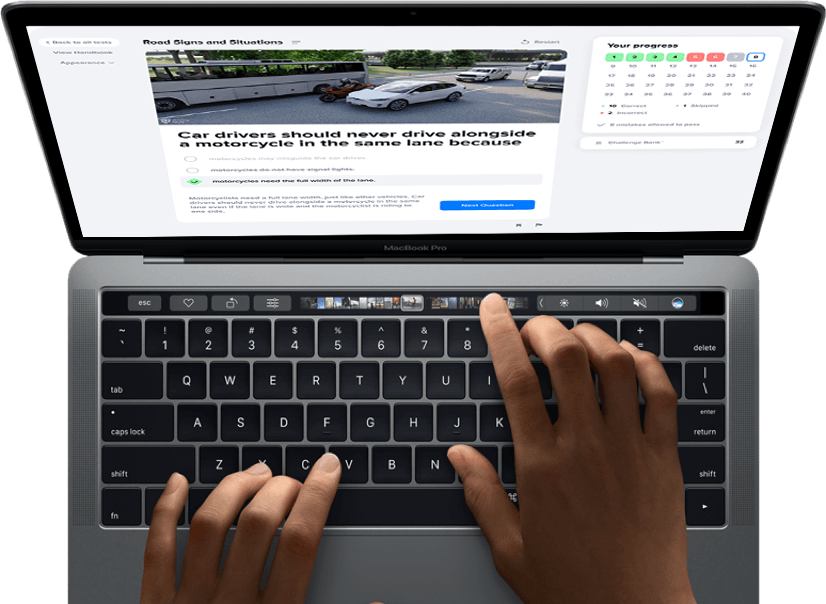

You’re reading one of our “Beginner Driver’s Guide” articles. Need to practice for your upcoming exam? Take our free sample driving test -- no registration required! ✨

The following video contains more factors that might influence your decision.

Financing a used car, however, can be a little trickier than getting a loan for a new one. Although as a young driver with limited credit history you are more likely to be approved for and be able to afford a used car, especially with the help of a co-signer, you might have to put in a little more work to obtain a willing lender.

Here are some financial tips for several situations you might encounter when purchasing a used car:

Buying A Used Car: 3 Financial Tips For 3 Different Situations

- 1

Buying a certified used car from a dealership

Certified used vehicles are typically found at dealerships that sell new cars of the same make. For example, a Ford dealership might carry a small selection of late model Ford vehicles that are certified to be in excellent condition by Ford mechanics, as well as their normal selection of brand new Fords. Buying a certified used vehicle from a dealership will be most similar to purchasing a brand new car in that you may seek financing directly from the manufacturer, lenders who have partnerships with the dealership, or you may seek a loan on your own at local banks and credit unions. Certified used cars are going to be the most expensive pre-owned vehicles on the market, especially those that include a warranty. Putting a down payment on this type of vehicle might help reduce its overall cost and make you more appealing to potential lenders. Here is why customers choose to buy certified pre-owned cars rather than new ones:

- 2

Dealerships that specialize in and sell only used vehicles

Another option to consider when searching for a used car and considering how you will pay for it is dealerships that specialize in and sell only used vehicles. These car lots are usually locally owned, smaller than national dealerships, and often market themselves to potential buyers who have a lower budget and/ or poor credit. If you are considering making a reliable used vehicle your first big financial purchase, used car dealerships are a great place to begin your search because they often have in-house financing. That means the owner(s) of the dealership are willing to let you make payments directly to them, not through a large lender or bank. Sometime used car dealerships are willing to let you have a weekly or bi-weekly payment arrangement, depending on your employer’s pay schedule, for a slightly higher interest rate. However, be weary of used car dealerships’ reputations for selling less than mint-condition vehicle. If you find a vehicle you like, copy it’s VIN (vehicle identification number) and use a service such as Carfax to search its vehicle history report for major accidents and insurance claims. Here is more to look at while choosing a used car:

- 3

Private Party Sale

Private party sales are a good option if you have plenty of time to search around for the perfect vehicle. Private party sales often yield the most reliable vehicles for the best price; however, you will be on your own when it comes to financing. If you choose to buy a vehicle from a private seller, you will have to obtain a loan from a bank or credit union. You may also have to coordinate with the current owner to transfer the vehicle’s title and registration, which can often be a hassle if they are still paying on their own auto loan.

No matter where you find your perfect used vehicle, you have several options to consider as you determine how you will borrow funds to purchase it.

Do your research and carefully consider each option before making the monumental decision to purchase a vehicle.